Amid the always volatile cryptocurrency sector, there's a dark underbelly that investors need to be cautious of – crypto pump and dump schemes. This article sheds light on how to recognize a pump and dump when you see one.

One of the downsides of any bullish crypto price run is a major uptick in the prevalence of crypto pump and dump schemes. This article identifies how to recognize a pump and dump when you see one.

Bitcoin, once an avant-garde digital asset, has now established its presence with regulated exchanges, US approved ETFs, institutional interest, and futures contracts. However, in general, the crypto space remains a wild frontier, with even seemingly reputable projects succumbing to attacks, as evidenced by the historic 51% attacks on Bitcoin SV and Ethereum Classic . Despite the bear market fluctuations, 2023 witnessed a surge in crypto scams with even more likely this year. Despite the seeming ‘legitimacy’ SEC-sanctioned ETFs bring to the market, investors must continue to exercise caution, as many seemingly genuine crypto projects are merely designed to exploit unsuspecting investors.

Recognizing these fraudulent activities is crucial for preventing investment losses. This is how to spot such schemes and protect yourself from falling victim.

What Is A Crypto Pump And Dump Scheme?

A crypto pump and dump scheme is a type of market manipulation where a group of people coordinate to buy a low-priced or obscure cryptocurrency, create hype and false information about it, and then sell it at a higher price to unsuspecting buyers. This results in a sudden spike and crash in the price of the cryptocurrency, leaving many investors with losses.

The origins of crypto pump and dump schemes can be traced to traditional securities fraud. These schemes targeted small-cap stocks in the equity market, involving a coordinated effort to artificially inflate the price of a stock and then swiftly sell for profit. In the cryptocurrency space, the same concept prevails, albeit with some variations.

In the crypto world, pump and dump operations focus on low-capitalization coins and tokens, exploiting their vulnerability due to limited trading volumes. Instead of traditional boiler rooms, these schemes rely on social media and other platforms to spread hype and misinformation about a particular cryptocurrency. These orchestrated campaigns often involve manipulating discussions on platforms like YouTube, Twitter, Reddit and Instagram, luring investors into believing that a project is gaining traction when that is not the case.

Identifying the Telltale Signs of a Pump and Dump Scheme

Detecting a pump and dump scheme requires vigilance and an understanding of red flags. Here are some key indicators:

- Unexplained Price Surges: Sudden, substantial price increases without a clear catalyst can be indicative of a pump and dump scheme.

- Paid News Articles and Social Media Hype: A small-cap coin being widely covered in paid news articles and experiencing a surge in social media attention often suggests a pump in progress. Chat groups, forums, or influencers are often engaged to spread positive but unsubstantiated or misleading claims about the cryptocurrency, such as partnerships, endorsem*nts, upcoming events, or technical breakthroughs.

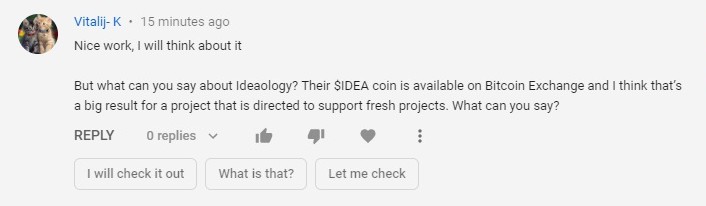

The comments section of crypto-related videos on YouTube is a prime target for coin hype. In this scenario, people attempt to hijack discussions and inject comments about a coin they are trying to hype into otherwise genuine conversations. As the examples below show, the format is easily recognizable – typically beginning with a thank you and then an inquiry about a certain coin or project. Posted on many other channels, these types of comments give the impression there is genuine enthusiasm about a project, whereas, in reality, there is no such groundswell of interest.

Communication among pump and dump group members happens on encrypted messaging services such as Telegram, where groups can contain several thousand members. In these group chats, a coin that will be pumped will be announced after the original perpetrator of the scam buys the coin. Within minutes, group members also buy and then spread fake news about the coin on social media, blogs and sometimes even on news outlets thought of as reputable through paid-for sponsored content. Once the price has jumped, the initiators of the pump sell their coins, followed by other members in the pump and dump messaging group. Then the price collapses again, leaving all investors who bought after the price surge with steep losses.

Paid media is also often used to hype coins – with press releases from criminal frauds published without question by many crypto media outlets – and even appearing on reputable sites like PR Newswire.

- Low Trading Volumes and Market Capitalizations: These schemes thrive on illiquid cryptocurrencies, so avoiding such assets can significantly reduce your risk. Pump and dump coins usually have a low market capitalization, trading volume, and liquidity, making it easier to manipulate the price with relatively small amounts of money.

- Listings on Obscure or Unregulated Exchanges: Here there is less oversight and transparency. Exchanges like Coinbase, Kraken, Binance and others have strict listing rules and the process is expensive. This discourages scam coins.

- Active use of FOMO: Pump and dump promoters will often urge potential buyers to act quickly and not miss out on a once-in-a-lifetime opportunity, creating a sense of urgency and fear of missing out.

- Questionable Investment Advice: Be cautious of investment advice from social media and unverified sources, as these can lead to significant losses. Investment advice from celebrities is particularly high risk.

Lessons from Celebrities: McAfee, Musk, and More

In the world of crypto pump and dump schemes, celebrity endorsem*nts have often played a role in shaping the narrative. For instance, in May 2021 tech entrepreneur John McAfee faced Commodity Futures Trading Commission (CFTC) charges for his involvement in pump-and-dump initiatives linked to various cryptocurrencies.

Authorities alleged that between 2017 and 2018, McAfee promoted a “coin of the day” via his Twitter account without disclosing to his followers that he had purchased positions in coins such as Verge, Doge and ReddCoin, that he would sell once the price pumped.

Celebrity endorsem*nts like McAfee’s should always be treated with scepticism. It is against the anti-touting provisions of US securities laws for celebs to make such endorsem*nts without revealing they’re being paid to do so – but it happens all the time.

Actor Steven Seagal, for example, found out he wasn’t above the law in 2020 and settled charges of failing to disclose around a million dollars in payments he received for shilling Bitcoiin2Gen. Similarly, both Lindsay Lohan and YouTube influencer Jake Paul were charged by the SEC for illegally promoting Tron (TRX).

Similarly, Elon Musk faced accusations of manipulating the market through his tweets about Bitcoin. When Bitcoin fell more than 50% from its April 2021 high of $64,000, Musk denied claims that he had pumped and dumped it. At the time, Magda Wierzycka, the CEO of financial services firm Sygnia said, “the volatility we have seen is an unexpected function of what I would call market manipulation by Elon Musk.”

She accused Musk/Tesla of buying a position in BTC, then announcing its position to pump the price, before selling at the peak. It is worth remembering that Musk paid US$40 million in 2018 to settle SEC charges against him for his tweets about taking Tesla private.

Such instances underline the significance of scepticism towards celebrity endorsem*nts in the crypto realm, as these endorsem*nts often lack transparency and compliance with securities laws.

Shielding Yourself from Crypto Pump and Dump Schemes

To protect yourself from falling victim to pump and dump schemes:

- Avoid Illiquid Cryptocurrencies: Steering clear of coins with low trading volumes can minimize your exposure to such schemes.

- Verify Sources: Rely on credible sources for information and conduct thorough research before making any investment decisions.

- Community Vigilance: The cryptocurrency community often self-regulates, exposing fraudulent players that tarnish the industry’s reputation.

- Direct Project Engagement: Reach out to cryptocurrency projects directly to gain insights and clarity before investing. Pump and dumps and other frauds are usually completely anonymous. Also, the cryptocurrency being pumped will typically have no clear use case, roadmap, or development team behind it, making it hard to verify its legitimacy or value proposition.

- Independent Research: Conduct independent research to make well-informed investment choices, rather than relying solely on external advice.

CFTC’s Efforts in Curbing Pump and Dump Schemes

Recognizing the need to combat pump and dump schemes, the U.S. Commodity Futures Trading Commission (CFTC) has taken proactive measures. In a public advisory on pump and dumps, the CFTC advises investors to remain cautious and avoid making investment decisions based on sudden price spikes or social media tips.

Furthermore, the CFTC has introduced financial incentives for whistleblowers who provide valuable information that leads to uncovering such fraudulent activities. “Manipulative and fraudulent schemes, undermine the integrity and development of digital assets and cheat innocent people out of their hard-earned money,” says Acting Director of Enforcement Vincent McGonagle. “Financial innovation is constantly breaking new ground, and the CFTC’s enforcement efforts must keep up. We will always act to hold fraudsters and manipulators accountable for misconduct.”

Conclusion

As the cryptocurrency market continues to evolve, the threat of pump and dump schemes remains a persistent concern. By staying alert to the red flags and practicing due diligence as recommended above, investors can navigate this challenging landscape of crypto investment with greater confidence.