June 1, 2023

The S&P 500 Index option suite ranges from the standard size contract, SPX®, to the Mini-SPX (XSPSM) contract at 1/10th the size of SPX, to NanosSM at 1/100th the size of XSP.One of the many questions we get is why would a retail trader choose XSP versus the popular SPY ETF option? With both XSP and SPY having similar notional size (contract value), weekly expirations and PM-settlement, they are typically considered direct competitors. But XSP has a couple of advantages over SPY.

Settlement Style

SPY options settle into physical shares of the underlying SPY, which could result in market risk.In some cases, brokers will close out positions prior to the market close in order to prevent margin calls.Conversely, XSP index options are cash settled, meaning the trading account would be credited or debited the difference between the settlement price versus the strike price at close.

XSP options are European settled at expiration, eliminating the risk of early assignment. SPY options are American style, meaning that the contract can be exercised or assigned prior to expiration. In addition, American settled option contracts also have the risk of being exercised OTM after market close (“contra exercise”), increasing potential economic and tax risk for writers.

Tax Implications

The entire S&P 500 suite of index options have the potential ability to take advantage of 1256 tax treatment, with 60% of any gains taxed long term and 40% taxed short term.*SPY options gains on the other hand are taxed as short term capital gains (ordinary income) if held less than one year.

Extended Trading Hours

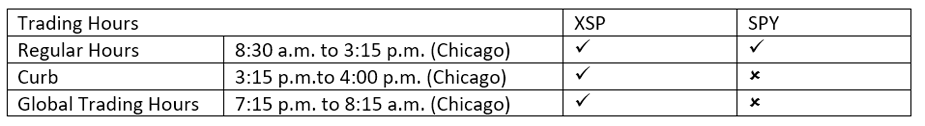

XSP is now available to trade during global trading hours, while SPY is only available during regular trading hours. Let’s look at the difference and why the added availability is an advantage.

With XSP’s additional trading hours, traders can take advantage of market moving events around the world around the clock.

Get Started with XSP

Now that you know the advantages of XSP, get started with XSP and explore more resources.

* Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options, including SPX Options, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code. Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

Global Trading Hours (GTH) The trading hours for options on the SPX, SPXW (SPX Weeklys and SPX End-of-Month), and XSP (Mini-SPX) begin at 8:15 p.m. Eastern time and end at 9:15 a.m. Eastern time. Curb session begins at 4:15 p.m. Eastern time and ends at 5:00 p.m. Eastern time. Please visit theGlobal Trading Hourspage for more details.

There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at:https://www.cboe.com/us_disclaimers.

These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position.

Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle.